Emergency Money: One Egg for 320 Billion Marks

Prof. Dr. Hans Frambach / Economic Science

Photo: UniService Transfer

Emergency money: One egg for 320 billion marks

Economist Prof. Dr. Hans Frambach on the development of emergency money 100 years ago.

How does inflation arise?

Frambach: The question of how it arises is a question of the causes. First of all, economic theory basically distinguishes between several types. There is, for example, what is known as supply-induced inflation. This is caused by factors that drive prices up, such as increases in factor prices, i.e. for energy sources, raw materials, wages. Companies will always pass on the increased prices to consumers. So inflation here is generated by supply. The second form, which is closely related, is the so-called imported inflation, which is the increase in prices of imported factors. A classic example of this is the oil crisis of 1973/74, when crude oil prices quadrupled worldwide in a short period of time. A further distinction is made between demand-induced inflation, in which the demand for goods and services increases to a greater extent than the supply and prices rise for this reason. Finally, we have the increase in the money supply. If the money supply were to be increased without, to put it simply, being countered by a corresponding volume of goods, then this would automatically be expressed in the rise in prices. This was then the situation of inflation 100 years ago, which resulted in the so-called hyperinflation of 1923. In order to be able to cope with the expenses and burdens of the First World War, the Reichsbank had increased the money supply, i.e. the printing press was fired up to provide the state with the corresponding liquidity. After the outbreak of the war in 1914, the money reserves were used up within a few days. Price increases were the result, which went to extremes in 1923. A famous example is letter postage: at the beginning of 1921, it was 0.4 marks, a year later it was 2 marks, in January 1923 it rose to 50 marks, and in the course of the year it exceeded the million mark mark mark. It was not until August 1924 that this chaos ended with the "currency reform" in the form of the introduction of the Reichsmark.

During the First World War, the Germans ran out of small change, so to speak, as all metals were needed for armaments, inflation rose and in order to still be able to pay wages, many municipalities issued the so-called emergency money. What kind of money substitute is this?

Frambach: Emergency money is a money substitute that can be used in bad times, such as wars or profound crises, when confidence in official money is no longer given, for example, due to an extreme devaluation of money. After World War II, for example, cigarettes were traded like a currency as a solvent medium of exchange. The U.S. dollar was considered a parallel currency in socialist states before and during the transition period. In general, valuable commodities such as grain or bread can also temporarily serve as currency substitutes and thus as emergency money. A theoretical, never realized precursor of the Rentenmark to stop hyperinflation was the so-called "rye mark." Another line of thought was potash salt, an essential ingredient for the economy. It is known from 1923 that, for example, the newly founded aluminum rolling mills in Baden-Württemberg produced Notscheine from printed aluminum foil. There were no limits to the imagination about the object and form of the Notgeld; it practically served as a means of payment.

There were a total of four periods of German Notgeld during and after the First World War. The first period was called the period of small nominals. During this period, precious metals were needed for armaments, but many people hoarded 50 pfennig and 1 mark pieces, so the first emergency bills were issued in East Prussia as early as 1914. By 1915, there were a total of 450 offices throughout the German Reich that were authorized to distribute emergency money. From 1916-21 came the second period, in which, due to a shortage of raw materials, base coins became scarce. The increasing fear of losing the war led to further hoarding of cash, so that the government commissioned a total of 580 banks, savings banks, cities, counties, but also private companies to ensure the money supply with their own issues. These "circulation expenditures" intended for the circulation of money were, according to the original goal, to have a limited validity until February 1, 1919. However, things turned out differently, and the theory was overtaken by practice. In addition to the Notgeld bills, there were other forms that were declared legal tender, e.g. interest coupons of war bonds. The third period then went from 1922-23 and the last period from August 1923 with the hyperinflatiion to 1924.

In addition to forms of money, however, there were other materials with which one could pay. What were these?

Frambach: Apart from the forms of money on printed paper or foreign currencies such as the dollar, materials were used to which people attached a value, which could be exchanged. Valuable goods included grain, bread, sugar, wood, coal, but also materials such as cutlery, porcelain, cardboard, leather, pressed coal, silk or linen. All these things were bartered and thus served as another form of money.

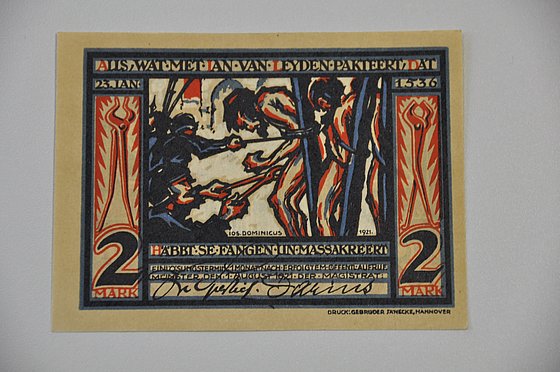

Emergency Money

In 1921, one could hold in one's hands banknotes worth, among other things, 100 million marks. How did such sums get onto a banknote and who put them into circulation?

Frambach: The Reichsbank, i.e. the central bank of the German Reich (1876-1945) based in Berlin, was responsible for issuing banknotes. It was basically commissioned by the Reich government through the Ministry of Finance. Another four major banks, the Badische Bank, the Bayerische Notenbank, the Sächsische Bank zu Dresden, and the Württembergische Staatsbank, had already enjoyed note privileges to some extent long before the outbreak of the First World War. In wartime, banks, savings banks, cities, municipalities, counties and private companies were then also commissioned by the government to put "legal tender" into circulation as emergency money. Thus, hundreds of banks, savings banks, cities, etc. circulated money on behalf of the state bank for certain "transport expenditures," which they did not do for free - an apparently lucrative business that was later even to be taxed, but never came to pass.

Emergency Money

In many places, local emergency money with partly artistic and city-historical motifs was created, e.g. for Münster. These issues are called series bills and were already banned in 1922. Did everyone do what they wanted in the meantime?

Frambach: Serial bills are emergency bills made of paper that were printed and put into circulation in Germany during the inflationary period from 1917 to 1922 by cities and municipalities, but also by private individuals, as a substitute for the missing small change. Their validity was limited and usually lasted only a few days at fairs or other events. In many places, local emergency money was created, some with artistic and town-historical motifs. These so-called series bills often did not come into circulation at all and were often only printed for collectors. Examples of series bills are the Berlin city treasury bills of 1921, where there was a bill worth 50 pfennigs for each city district, or Eisenach 1921 with "Luther on the Wartburg". Among these, sometimes really small works of art can be found.

The issuance of serial bills and other emergency money was prohibited by Reich law of July 17, 1922. However, a strike of the workers of the Reichsdruckerei in the same month caused another acute shortage of money, so that the ban could not be enforced at all. Incidentally, this dates the beginning of the third period of emergency money. Thus, the first banks and savings banks were again instructed to issue emergency money (mostly bills of 500 and 1000 marks). As of September 18, 1922, the Reich government again authorized the issuance of emergency money by decree of the Minister of Finance, which gave these issues an official character. A total of 715 issuing agencies participated in these emergency money issues. Beginning in February 1923, these bills were then recalled in most parts of the country.

In November 1923, it is estimated that 84% of the banknotes in circulation consisted of emergency money. What was it possible to buy with this money?

Frambach: In August 1923, new regulations came into force, and this is now the beginning of the fourth period. Banknotes and checks were printed with a face value slightly lower than the face value of the Reich banknotes circulating at the same time. Initially 100,000 to 5 million marks, occasionally up to 100 trillion marks. Reliable estimates of currency in circulation are available only for November 15, 1923. Of the total cash in circulation worth 988 million gold marks, which corresponds to an approximate value of almost 93 trillion (9.3 x1019) paper marks, approximately 155 million gold marks circulated in Reich banknotes, from which it is concluded that 84.5% of the currency in circulation consisted of emergency money.

What could be bought with the hyperinflationary emergency money? Basically, everything that people were willing to give away in exchange for the emergency money. Essentially, it was goods for everyday use, especially basic foodstuffs, because people were starving. But the big problem with hyperinflation was that the value of money changed massively from one day to the next. You could no longer buy the next day what you could buy the day before. For example, on June 9, 1923, an egg in Berlin cost 800 marks; on December 2, it already cost 320 billion marks. People calculated in bundles instead of bills. Money was transported in wheelbarrows, bundles were misused as heating material, the reverse side was used as scratch paper, walls were wallpapered with banknotes, and so on. Money was no longer worth anything.

In November 1923, the era of multicolored bills as a means of payment came to an end with the introduction of the Rentenmark. Although it existed until 1948, it was not legal tender at all, but a transitional currency. What does that mean?

Frambach: Officially, the Rentenmark was valid in Germany from 1923 to 1948 as a so-called land charge-backed transitional currency. Its acceptance was greatly helped by its supposed, but not real, "backing" by land. In fact, the Rentenmark remained stable in value solely because it was held in short supply. From November 1, 1923, Deutsche Rentenbank issued new banknotes to the population in parallel with the billions and trillions of paper mark nominal bills in circulation and the emergency banknotes. The Rentenmark was not legal tender, but a bearer bond of Rentenbank. The exchange rate to the paper mark was set at 1:1 trillion, exactly on November 20, 1923, by determination of the Reichsbank, when the exchange rate to one U.S. dollar was 4.2 trillion paper marks. This corresponded to the pre-war gold mark parity to the gold dollar. The Rentenmark was immediately accepted by the population, probably also because after these years of chaos, there was hope that something reliable was now available. In any case, inflation came to an abrupt halt. People spoke of the "miracle of the Rentenmark.

On August 30, 1924, the Reichsmark was introduced in addition to the Rentenmark. It was valid at a ratio of 1:1 to the Rentenmark, so the Reichsmark did not replace the Rentenmark, as is often claimed. Rather, it was still possible to pay with both currencies. The main difference between the two currencies was their different cover. With the introduction of the Reichsmark, the use of the term "Rentenmark" - despite the circulation of both - was prohibited by law in all official documents. No German sovereign symbols are depicted on any Rentenbank bill. The Rentenmark continued to exist beyond 1924 and was valid in all Allied occupation zones until the currency reforms of 1948. Originally, the Rentenmark was to be completely replaced by the Reichsmark by 1934 at the latest, but this was not implemented.

The currency reform of 1948 then introduced the Deutsche Mark, which remained valid until the changeover to the euro. After all, there are still at least 12.4 billion Deutschmarks lying around in drawers or basements today. Is this the new emergency money for those who don't trust the euro?

Frambach: Short answer: Yes, certainly some are still hoping for the return of the Deutsche Mark or see themselves well prepared with the stocks they have held. Others hold the money out of sentimentality and memory or the speculative hope of future appreciation.

The more detailed answer: the Deutsche Mark was valid in the FRG from 1948 to 1998 as book money, and until 2001 only as cash as the official currency. The Deutsche Mark replaced the Reichsmark as the legal currency unit, even beyond the founding of the FRG on May 23, 1949, including West Berlin. Following the establishment of the European Economic and Monetary Union, the Deutsche Mark was replaced by the euro as book money on January 1, 1999 and as cash on January 1, 2002.

According to the Deutsche Bundesbank, DM banknotes with a nominal value of DM 5.77 billion and coins with a value of DM 6.61 billion, or a total of DM 12.38 billion, were still unchanged on July 31, 2021. This corresponds to 5.1% of the DM 244.8 billion in circulation in 2000.

Many Germans still regard the Deutsche Mark as the "stronger" currency compared with the euro. This is also due to the fact that the Deutsche Mark was seen as a symbol of the economic miracle in Germany, or to the fairy tale "Euro means Teuro", because many goods seem to cost in euros today what they cost in DM back then. However, this does not take into account the annual inflation rate, an effect that also existed in DM times.

After the introduction of the euro, there were high price increases in many cases, e.g. bee honey by 39% from 2001 to 2003, eggs by 15% or visits to the cinema by 8%, whereas prices for other goods such as rents or insurance hardly changed or even fell. Prices for energy, telecommunications and computers, for example, fell after the introduction of the euro. Today, it seems to me that the discussion about abolishing the euro is largely off the table.

Due to the different weighting of the individual factors (in the basket of goods) and the opposing development of prices in various areas, the overall inflation rate has been relatively low, averaging below 2% since monetary union. Only in the last weeks of the Corona period have we seen higher price increases, currently at 3.9%. Seen since the introduction of the euro, however, this is the exception. So far, the euro is one of the most stable currencies and is superior to the D-Mark in this respect.

Uwe Blass (conversation of 09/30/2021)

Prof. Dr. Hans Frambach heads the Department of Microeconomics and History of Economic Thought in the Faculty of Economics, Schumpeter School of Business and Economics at Bergische Universität.